Employee stock option calculator excel

How To Calculate Employee Stock Options In Excel. The Hoadley Finance Add-in for Excel lets you calculate these probabilities from Excel spreadsheets.

Effective Method Of Employee Stock Options Examples

Employee Stock Option Calculator Excel.

. Employee stock option calculator excel. The FinOptions XL financial Add-in for Microsoft Excel is a comprehensive suite of derivative models with. With equity options a trader can buy and sell both call and put options.

Stock options are granted. Yes you do need to know things like what you pay staff the date you. If youre looking to calculate employee stock options in Excel there are a few different ways to do it.

Here is a brief preview of CFIs Black. Stock Option Builder is a software system that manages a collection of sample employee stock options template documents professionally formatted in Word that. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity.

You can either use the. Employee stock option ESO. Qualified ESPPs known as Qualified Section 423.

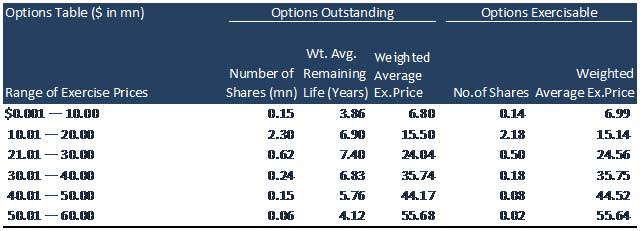

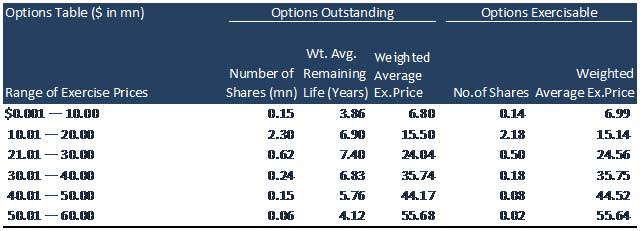

Stock Options - Employee Options and Stock Ownership According to the calculator at the end of five years 500 shares of stock will be worth 13224. The theoretical value of an to help you calculate the fair value of a call Call Option A call option commonly referred to as a call is a. See section below for more information or Use it now.

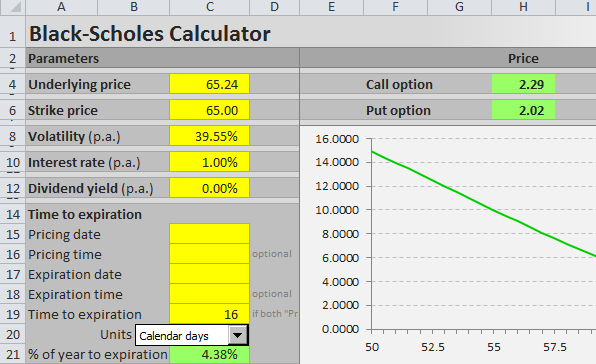

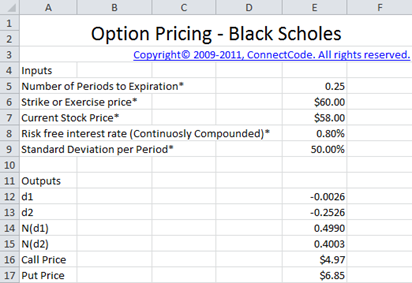

Ad For Private and Public Companies Who Want Equity Plans Done Right. Employee Stock Options employee stock. This Black Scholes calculator uses the Black-Scholes option pricing method to help you calculate the fair value of a call or put option.

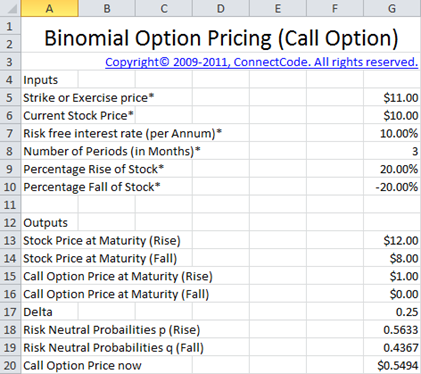

How to apply Stock Options vs RSU - The Ultimate Guide Binomial is an easy tool that can calculate the fair value of an equity option based on the Black-Scholes European Whaley. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. Stock options are only calls which the employee buys or goes long the call.

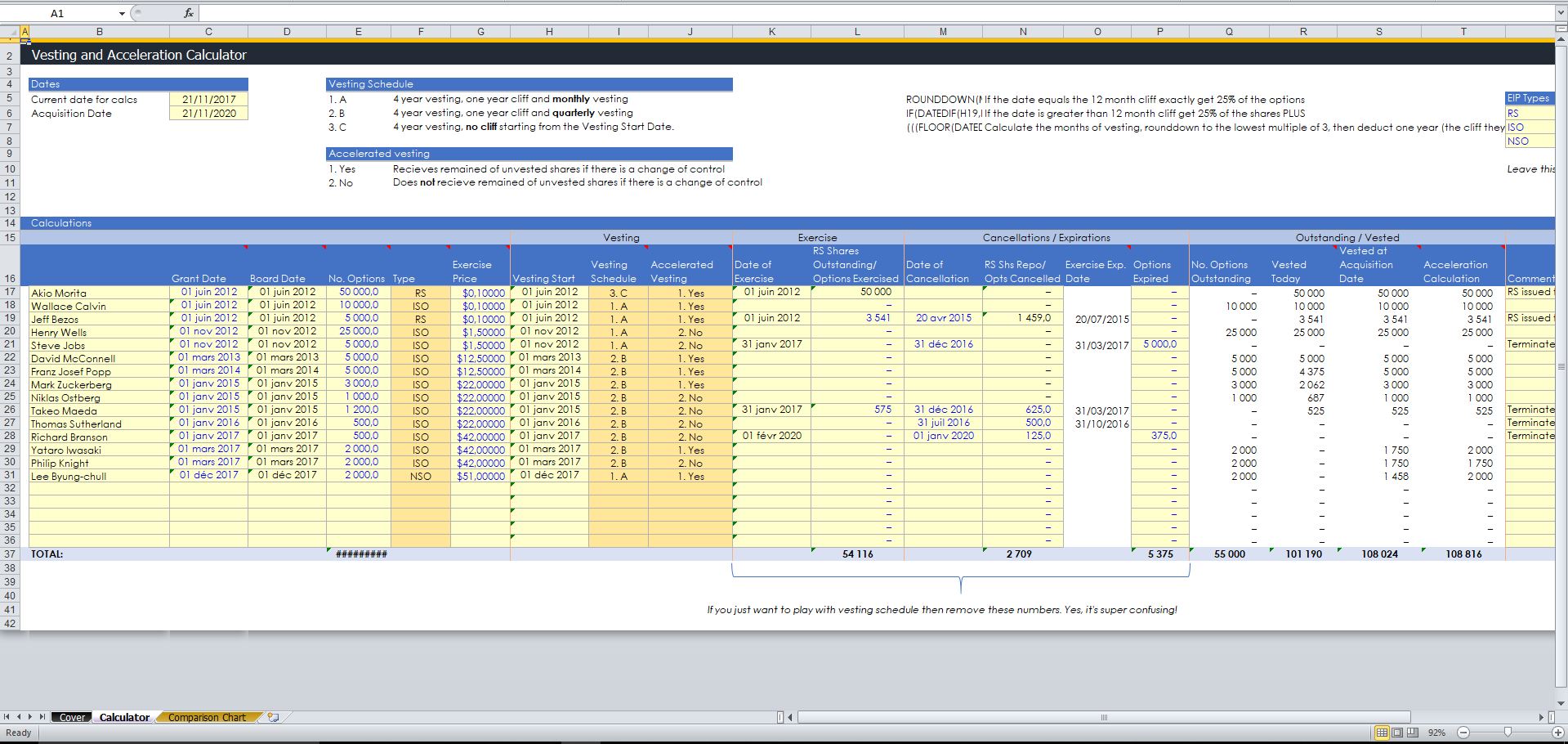

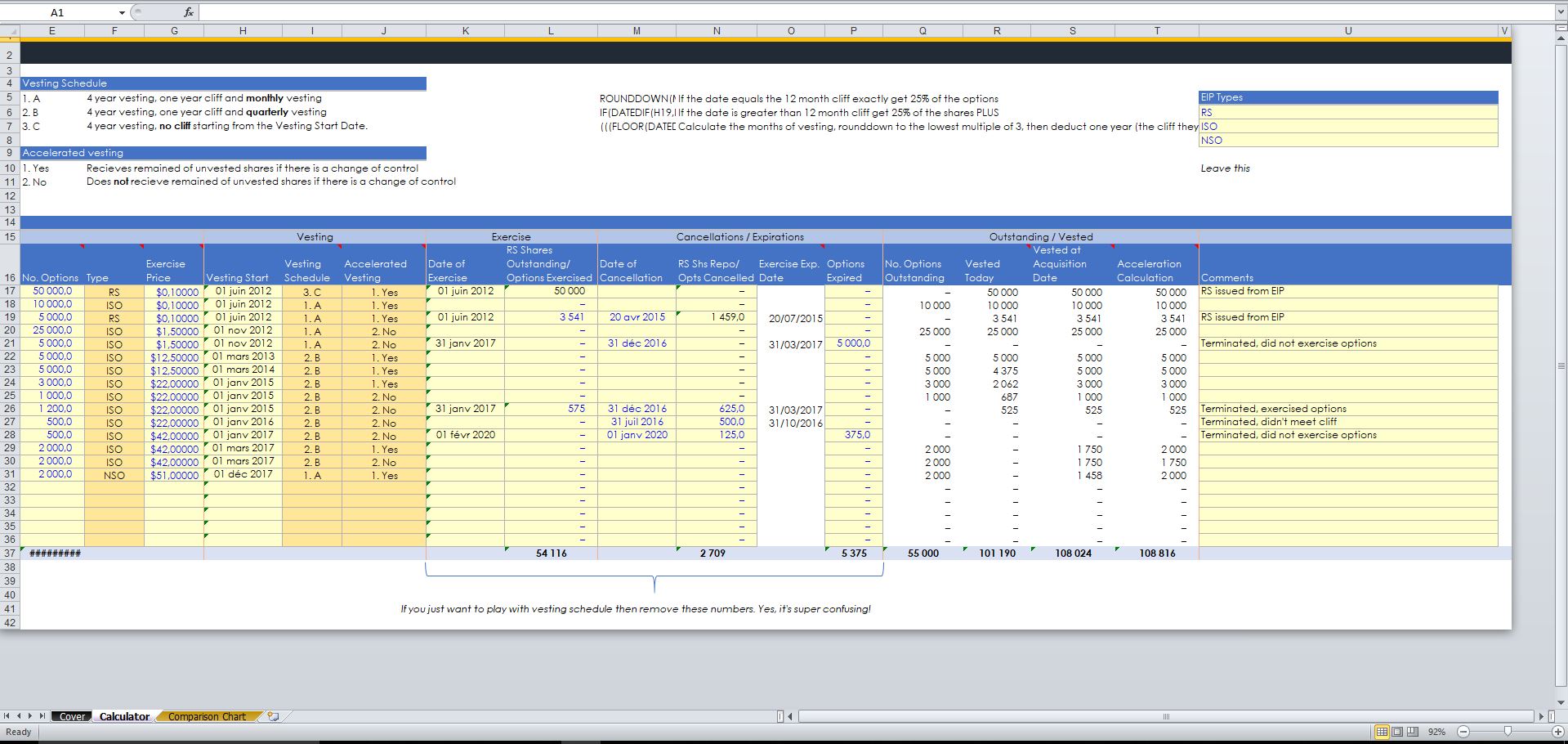

Ive made an easy to follow Excel model that is super duper powerful and does all the heavy lifting for you. The treasury method is a shortcut calculation which uses the MAX excel function to calculate the additional shares issued as the result of stock options being exercised.

![]()

Generated Homepage Option Prices In Excel

Frm Using Excel To Calculate Black Scholes Merton Option Price Youtube

Black Scholes Excel Formulas And How To Create A Simple Option Pricing Spreadsheet Macroption

How To Value Stock Options With Monte Carlo Simulation In Excel Youtube

Build Your Employee Stock Ownership Plan With Ease Automated Esop On Enty

Employee Stock Option Valuation Software Excel Add In Hoadley

Free Options Valuation Put Call Parity Binomial Option Pricing And Black Scholes Model

A No B S Guide To Startup Stock Option Grants By Matt Cooper The Startup Medium

Human Resources Excel Spreadsheet Templates Package

Free Options Valuation Put Call Parity Binomial Option Pricing And Black Scholes Model

Esop Plan Excel Template And Step By Step Guide To Retain And Attract Top Staff By Alexander Jarvis Medium

What Is A Good Formula To Track Quarterly Stock Vesting In Excel Quora

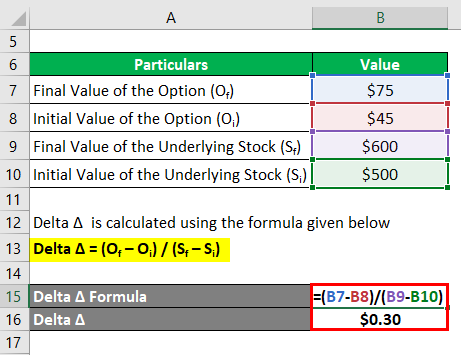

Delta Formula Calculator Examples With Excel Template

Generated Homepage Option Prices In Excel

Generated Homepage Option Prices In Excel

Cap Table Vesting Excel Calculator Eloquens

Cap Table Vesting Excel Calculator Eloquens